RAK Offshore:

Secure & Tax-Free

Business Setup.

RAK Offshore

Company Formation refers to establishing a business in Ras Al Khaimah International

Corporate Centre (RAK ICC), one of the UAE's leading offshore jurisdictions. It allows

foreign investors to set up companies with full ownership and benefits like tax

exemptions, confidentiality, and asset protection. RAK Offshore is ideal for businesses

seeking a cost-effective and secure platform for international operations. These

companies can hold assets, conduct international trade, and benefit from a flexible

regulatory environment. However, they are not permitted to operate directly within the

UAE market.

Steps to RAK Offshore

Company Formation

- Choose a Business Activity:

Select a business activity that complies with RAK ICC

regulations (e.g., holding companies, trading, consultancy).

- Appoint a Registered Agent:

Engage an approved registered agent who will guide you

through the formation process and handle legal requirements.

- Select a Company Name:

Choose a unique name that meets RAK ICC naming

guidelines and get it approved.

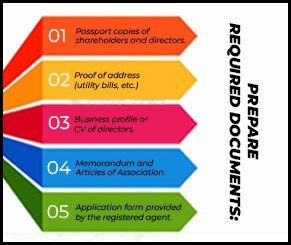

- Prepare Required Documents:

• Passport copies of shareholders and directors.

•Proof of address (utility bills, etc.)

• Business profile or CV of directors.

• Memorandum and Articles of Association.

• Application form provided by the registered agent.

- Submit Application and Documents:

Submit all required documents to the registered agent

for processing and submission to RAK ICC.

- Pay Fees:

Pay the necessary registration, license, and agent fees

for the company formation.

- Receive Incorporation Certificate:

Get the official registration and company documents.

- Open a Bank Account:

Set up a corporate bank account to facilitate business

operations.

- Renew Annually:

Ensure compliance and renew the offshore company each

year.

Advantages of

RAK

Offshore Company Formation

- Tax Exemptions:

No corporate, income, or capital gains taxes

on

offshore companies.

- Full Ownership:

100% foreign ownership without the need for a

local sponsor.

- Confidentiality:

Shareholder and director details are not

publicly

disclosed.

- Asset Protection:

Safeguard assets from political and economic

risks.

- Global Market Access:

Facilitates international trade and business

expansion.

- Cost-Effective:

Lower setup and operational costs compared to

onshore entities.

- Flexible Structure:

Can be used for holding assets, intellectual

property, or international trading.

- No Currency

Restrictions:

Freedom to operate in multiple currencies.

- Easy Setup:

Quick and straightforward registration process

Are you ready to grow your business?